EXECUTIVE SUMMARY

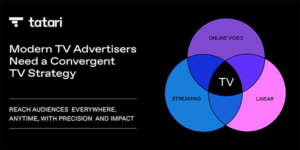

The first few months of 2022 continue a two-year trend of immense change for the future of TV and consumer engagement. Cord cutting continues to accelerate. The flood of incredible content into the streaming marketplace continues unabated, capturing an ever larger share of total TV viewership time just as the Academy crowned the first ever streamer as its Best Picture winner. At the same time, our industry has undergone substantial shifts related to how we are positioning for the future of measurement and consumer engagement across every screen in our lives. Both Disney and NBC Universal signaled the end of the single currency world, embracing a multi-currency model that truly empowers advertisers and content owners alike.

In this quarter’s State of Viewership Report, the data further showcases the challenges advertisers face in reaching fresh audiences and validates the need to embrace these new models to future proof advertising for the next generation. We saw more and more households shift away from linear this quarter, with the rate of cord-shaving up 20% year-over-year. The picture gets even more unbalanced when we look deeper into the data, with one in four millennials (A25-34) watching less than one hour of

linear TV per week, and households under the age of 45 exposed to 24% fewer linear ads than homes with older viewers.

The unbalance of linear reach remains a real problem for linear advertisers, with the vast majority of linear ad impressions (94%) reaching and oversaturating the same 55% of TV viewers. Moreover, linear ads disproportionately reach older, white viewers, while leaving Gen Z, millennials, and diverse audiences less likely to be exposed.

Despite the flock to OTT, streamers too face substantial challenges in maintaining growth and retaining subscribers. Samba TV data from the quarter shows us that consumers are willing to shift subscriptions at will and the need to maintain fresh content is at a record high. In fact, many OTT viewers only watch one program per streamer, creating significant exposure for subscriber churn in an SVOD-only model.

With the first quarter of the year now behind us, the data from Samba TV’s State of Viewership report paints a clear picture of a robust and growing CTV market, and at the same time validates the steps being taken across our industry to embrace a flexible advertising model that empowers advertisers to reach their audiences anywhere, on every screen.

Read more: SambaTV SOV Q1 2022 US